Empower Employees with Mobile Solutions to Improve the Bottom Line

Now that there is an app for nearly every conceivable function, companies have realized that their second largest expense, travel, can be fully automated – bringing a new level of insight, analysis and negotiation to the ubiquitous expense report. Gone are the days of paper, calculators and spreadsheets for the tedious yet mandatory task of reimbursement. In their place are flashy smartphone apps that track the traveler’s location and purchases and create expense transactions automatically. These mobile solutions are linked to cloud-based expense management systems that provide immediate feedback to the employee when policies have been breached. They also provide high-visibility notification for approvers when compliance conditions are not met, allowing firms to exert greater control over their operating expenses to adhere to client requirements and firm policies. Requiring employees to manually complete expense reports, which not only wastes time but also drives up costs through lost productivity and increased staffing, is no longer a viable option. In today’s economy, it’s either increase productivity or suffer reduced profitability.

5 Ways CFOs Are Reducing Company Costs Right Now

A requirement of every chief financial officer’s job is to find ways to improve the company’s profitability. Improvements can be accomplished by making the best use of corporate funds and reducing expenses. How CFOs reduce company costs can vary greatly from one business to the next. The industry type, business size and corporate structure are all important factors.

The Data Behind Expense Key Performance Indicators

The way to drive performance is to measure it. Do you want to judge the success of a project? Do you want to change people's behavior? You need to create Key Performance Indicators (KPI) that quantify the objectives you are striving for. Your KPIs may change from project to project and from year to year. But they should be consistent in their ability to measure the success or failure of any set of activities.

Best Ways for a Small Business To Get a Handle on Finances & Expenses

There is a popular saying in the South that is appropriate in the world of small business: “It’s hard to drain the swamp when you’re up to your elbows in alligators.” For small-business owners, with limited time and resources, it is difficult to keep control of finances when most of your time is spent just keeping the business going. Customers are calling, shipments must be unloaded, orders are pending, and employees are complaining. All of these distractions can keep a small-business owner or manager from taking a hard look at finances.The issue is not necessarily when to examine finances, but how small businesses manage expenses and finances. Applying the following tips could actually give you the time you need to get a handle on your finances:

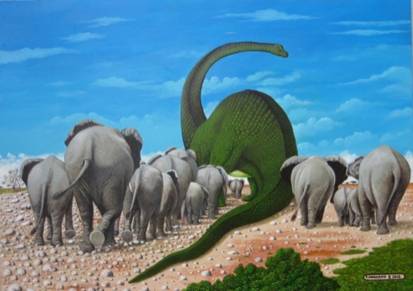

A Stranger Among Us

World-renowned Italian artist Franco Innocenti lives in what remains of a 10th century castle tower and paints the world as he sees it. His paintings reveal a reality different from the one to which we are accustomed, as Franco removes objects from their natural environments and places them in completely unusual surroundings, creating absurd combinations that reveal paradoxical aspects of the world around us.

Automated Invoicing: 3 Ways It Can Improve Efficiency

In any business there are specific questions that should be part of every continuous improvement plan:

Why Your Organization Can't Risk Expense Report Inaccuracies

Few would argue with the truism “Numbers don’t lie,” but inaccurate numbers can and do lie all the time. A good example is the vast number of inaccurate numbers that can enter an organization’s financial system via expense reports. Organizations that allow employees to write or type expenses into a form that is manually reviewed and re-entered into the accounting system by a staff member have introduced several opportunities to enter inaccurate information for each transaction.

9 Best Practices for Automating your AP Department: Part 3 of 3

In this third and final part of our three-part series, we will conclude our discussion on accounts payable best practices fueled by the excellent article "9 Best Practices for Automating Your AP Department" written by David Schmidt and Katie McMurry for the third-quarter printing of Financial Operations Matters. It provides an excellent roadmap for automation that is both commonsensical and actionable.

A Solid Case for Accounts Payable Automation

To my mind, it seems absurd that one organization selling products or services to another submits a printed paper invoice via their billing system and an employee at the purchasing company manually enters the same invoice into their accounts payable system. Not only is this an inefficient and expensive exercise, but it is totally eco-unfriendly!

9 Best Practices for Automating your AP Department:Part 2 of 3

In this second part of a three-part series, we will resume our discussion of Accounts Payable Best Practices (Part 1) fueled by an excellent article entitled "9 Best Practices for Automating Your AP Department," written by David Schmidt and Katie McMurry. Their work appeared in the Third Quarter printing of Financial Operations Matters and provides an excellent road map for automation that is both commonsensical and actionable.